Origin of Cryptocurrencies

Origin of Cryptocurrencies

Introduction

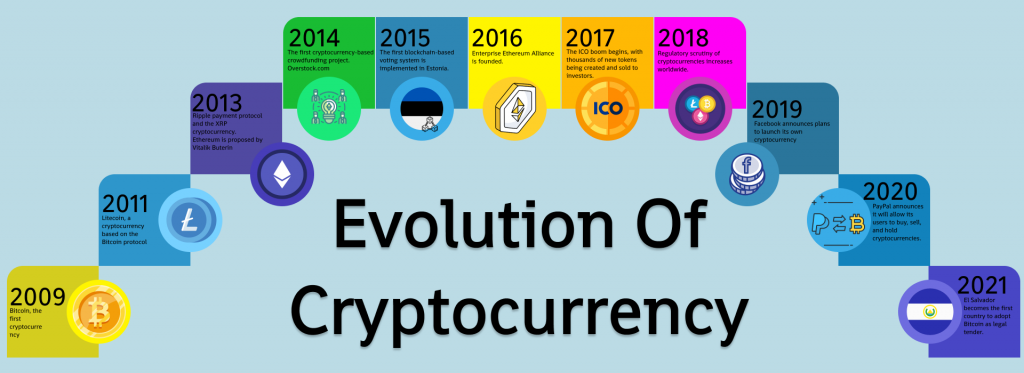

Origin of cryptocurrencies have emerged as a revolutionary concept, transforming the way we perceive, manage, and exchange value. From Bitcoin to Ethereum and countless altcoins, the cryptocurrency landscape has exploded since its inception. But where did it all begin? In this article, we will explore the origins of cryptocurrencies, their evolution, and their impact on the financial world.

The Birth of Cryptocurrency

The story of cryptocurrencies begins in 2008 with the publication of a whitepaper titled “Bitcoin: A Peer-to-Peer Electronic Cash System” by an individual or group using the pseudonym Satoshi Nakamoto. This groundbreaking document introduced the concept of a decentralized digital currency that could operate without the need for a central authority. The vision was clear: to create a system that enables secure, peer-to-peer transactions over the internet.

1. The Concept of Blockchain Technology

At the core of Bitcoin lies blockchain technology. A blockchain is a distributed ledger that records all transactions across a network of computers. This innovative technology ensures transparency, security, and immutability, making it virtually impossible to alter transaction history. The decentralized nature of blockchain eliminates the need for intermediaries, allowing users to transact directly with one another.

2. The Launch of Bitcoin

On January 3, 2009, Nakamoto mined the first block, known as the “genesis block,” marking the official launch of Bitcoin. The first transaction occurred shortly after, and Bitcoin began to gain traction among tech enthusiasts and libertarians who valued the principles of decentralization and financial sovereignty.

The Growth of the Cryptocurrency Market

3. Early Adoption and the Emergence of Altcoins

As Bitcoin gained popularity, the idea of cryptocurrencies began to spread. In 2011, several alternative cryptocurrencies, or altcoins, were created, including Litecoin and Namecoin. These early altcoins aimed to improve upon Bitcoin’s limitations, such as transaction speed and mining efficiency.

4. Ethereum and Smart Contracts

The cryptocurrency landscape experienced a seismic shift in 2015 with the launch of Ethereum. Founded by Vitalik Buterin, Ethereum introduced the concept of smart contracts—self-executing contracts with the terms of the agreement directly written into code. This innovation opened the door for decentralized applications (dApps) and a new wave of cryptocurrencies built on the Ethereum blockchain.

The ICO Boom and Increased Regulation

5. The Rise of Initial Coin Offerings (ICOs)

In 2017, the cryptocurrency market witnessed a surge in Initial Coin Offerings (ICOs), a fundraising method that allowed projects to raise capital by issuing their own tokens. Many startups capitalized on the hype surrounding cryptocurrencies, leading to a wave of new projects and innovations. However, this also attracted significant attention from regulators, raising concerns about fraud and investor protection.

6. Regulatory Developments

As the cryptocurrency market grew, governments and regulatory bodies worldwide began to take notice. Countries like the United States, Japan, and the European Union implemented regulations to govern cryptocurrency exchanges and protect consumers. This regulatory scrutiny aimed to create a safer environment for investors while fostering innovation in the blockchain space.

The Current Landscape of Cryptocurrencies

7. Diversification and the Rise of Stablecoins

Today, the cryptocurrency market boasts thousands of cryptocurrencies, each with unique features and use cases. Stablecoins, such as Tether (USDT) and USD Coin (USDC), have gained popularity as they aim to maintain a stable value by pegging themselves to fiat currencies. This stability makes them attractive for trading and as a medium of exchange.

8. DeFi and the Future of Finance

Decentralized Finance (DeFi) has emerged as a major trend within the cryptocurrency space. DeFi platforms allow users to lend, borrow, and trade assets without intermediaries, offering users greater control over their finances. The DeFi movement has the potential to disrupt traditional financial systems by providing financial services to the unbanked and underbanked populations worldwide.

Conclusion

The journey of cryptocurrencies began with a vision of decentralization and financial freedom, and it has evolved into a dynamic and diverse ecosystem. From Bitcoin’s humble beginnings to the rise of Ethereum and DeFi, the impact of cryptocurrencies on our world is undeniable. As we look to the future, the potential for innovation and disruption in the financial sector remains vast, promising an exciting horizon for cryptocurrencies and blockchain technology.

Keywords: Cryptocurrencies, Bitcoin, Blockchain Technology, Ethereum, Altcoins, Smart Contracts, ICOs, DeFi, Stablecoins, Cryptocurrency Market

By understanding the origins and evolution of cryptocurrencies, we can better appreciate their potential to reshape our financial landscape and the broader implications for society. The future of money is here, and it is decentralized.